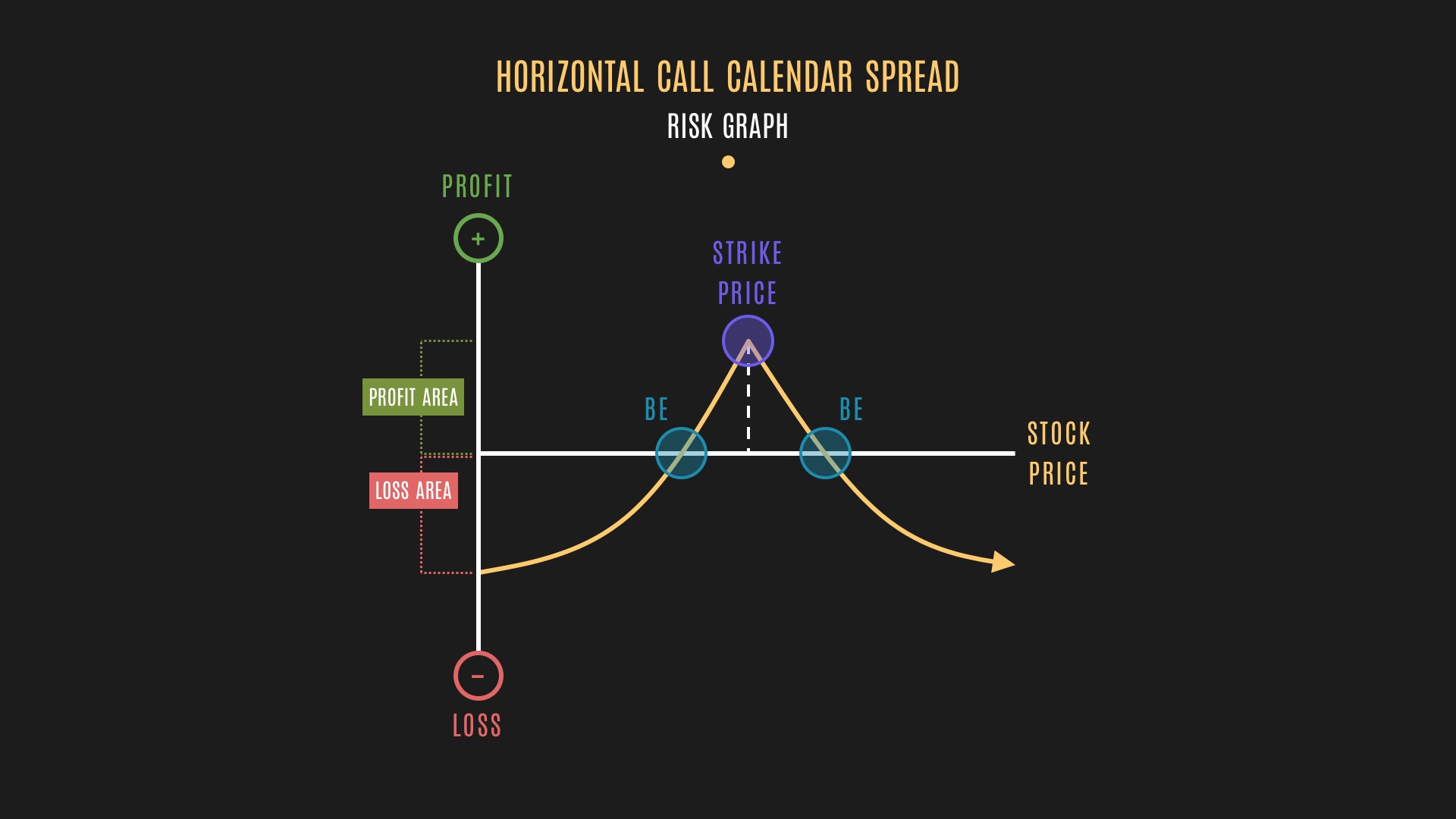

What Is A Calendar Spread. A calendar spread is an option strategy where an investor buys an option while simultaneously selling an option of the same type with the same strike price but with a different. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but.

A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but. With visa stock trading around 214, a bullish. A calendar spread is an options strategy that entails buying and selling a long and short position on the same stock with the same strike price but different expiration dates.

What Is A Calendar Spread?

The calendar spread refers to a family of spreads involving options of the same underlying stock, same strike prices, but different expiration months. It involves selling an option with shorter expiration date. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but.

There Are Several Types, Including Horizontal.

A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different. Option prices are set differently depending on the maturity and strike price. A calendar spread is initiated for different options with the same underlying asset and same strike rate but different expiration dates.

A Calendar Spread Strategy Is Utilized When There.

They allow you to take advantage of time decay as well. A calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type ( calls or puts) and strike price, but different. In finance, a calendar spread is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the sale of the same instrument.

With Visa Stock Trading Around 214, A Bullish.

Needless to say, a calendar spread requires the options to be of the same strike price and have the same underlying assets. Calendar spread trading is buying and selling options with different strike prices at the same. A calendar spread is an option strategy where an investor buys an option while simultaneously selling an option of the same type with the same strike price but with a different.

A Calendar Spread Is An Investment Strategy In Which The Investor Buys And Sells A Derivative Contract (An Option Or Futures Contract) For The Same Underlying.

A calendar spread is a long or short position in the stock with the same strike price and different expiration dates. The simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different expiration dates. For those who like the.